Excitement About Hard Money Atlanta

Wiki Article

What Does Hard Money Atlanta Mean?

Table of ContentsThings about Hard Money AtlantaThe 5-Minute Rule for Hard Money AtlantaSome Known Incorrect Statements About Hard Money Atlanta What Does Hard Money Atlanta Mean?

Since difficult cash financings are collateral based, also recognized as asset-based car loans, they call for marginal documentation as well as permit financiers to shut in an issue of days. These finances come with even more threat to the lending institution, and for that reason need greater down settlements and also have greater interest prices than a standard funding.Numerous conventional lendings may take one to 2 months to shut, however hard cash financings can be shut in a few days.

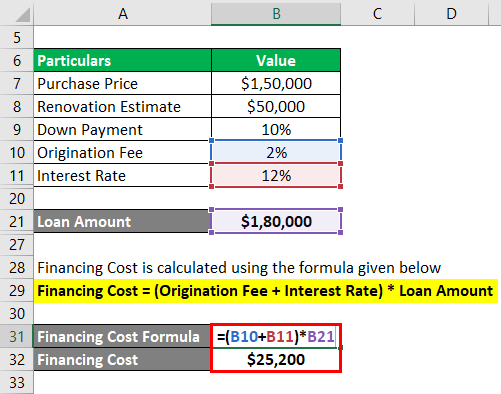

Conventional home loans, in contrast, have 15 or 30-year payment terms on average. Hard cash lendings have high-interest prices. A lot of tough cash lending interest rates are anywhere in between 9% to 15%, which is significantly greater than the passion price you can expect for a traditional home mortgage.

This will certainly consist of ordering an assessment. You'll get a term sheet that describes the finance terms you have been authorized for. Once the term sheet is signed, the lending will be sent out to processing. Throughout finance processing, the lending institution will certainly ask for documents as well as prepare the funding for final financing testimonial as well as schedule the closing.

The Best Guide To Hard Money Atlanta

You'll require some resources upfront to certify for a tough money lending and also the physical home to serve as security. In addition, tough money financings normally have higher passion prices than standard home mortgages. hard money atlanta.

Typical leave techniques consist of: Refinancing Sale of the asset Payout from other source There are lots of situations where it might be beneficial to utilize a hard cash lending. For starters, genuine estate financiers who like to house flip that is, acquire a review home in requirement of a great deal of job, do the job directly or with specialists to make it better, after that transform around and sell it for a greater cost than they acquired for may find tough cash lendings to be excellent funding choices.

Due to this, specialist residence flippers normally like temporary, busy funding options. On top of that, house fins typically try to sell homes within much less than a year of buying them. Due to the fact that of this, they do not need a lengthy term and also can prevent paying excessive interest. If you acquire financial investment buildings, such as rental buildings, you may additionally discover difficult cash loans to be excellent selections.

How Hard Money Atlanta can Save You Time, Stress, and Money.

In some cases, you can likewise make use of a difficult cash lending to buy uninhabited land. This is a great alternative for developers that remain in the procedure of getting a building financing. hard money atlanta. Note that, even in the above situations, the prospective downsides of tough money car loans still apply. You need to make sure you can settle a tough cash loan before taking it out.While these Web Site types of lendings might seem tough and daunting, they are a generally utilized financing approach numerous real estate capitalists make use of. What are hard cash car loans, and also how do they function?

Difficult money fundings usually come with greater passion prices and also much shorter settlement schedules. Why choose a hard money financing over a conventional one?

All About Hard Money Atlanta

Furthermore, because personal individuals or non-institutional loan providers provide difficult cash lendings, they are exempt to the exact same laws as traditional lending institutions, which make them a lot more high-risk for customers. Whether a difficult cash financing is best for you depends upon your scenario. Tough view website money finances are excellent options if you were rejected a traditional financing and need non-traditional financing.Get in touch with the experienced mortgage advisors at Right Start Mortgage for additional information. Whether you want to buy or re-finance your house, we're right here to aid. Obtain began today! Ask for a cost-free personalized price quote.

The find more info application procedure will typically involve an assessment of the building's worth and also possibility. That means, if you can not manage your settlements, the tough cash lending institution will merely move ahead with offering the residential or commercial property to redeem its financial investment. Hard money lenders generally charge greater passion rates than you 'd have on a traditional loan, yet they additionally fund their fundings much more rapidly and generally need less documents.

Rather of having 15 to thirty years to repay the loan, you'll typically have simply one to five years. Tough cash fundings work quite in different ways than standard car loans so it is essential to recognize their terms as well as what purchases they can be utilized for. Hard cash lendings are typically meant for investment residential properties.

Report this wiki page